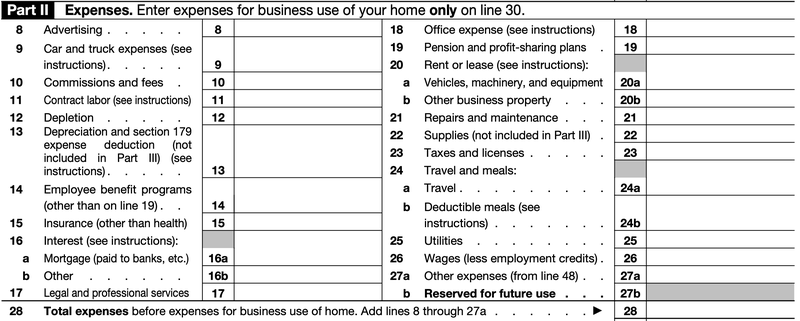

16/7/21 1099MISC Copy B–For the copy you'll ship to the contractor, you may both fill out a bodily copy of Kind 1099MISC or print off an digital model of Copy B from the IRS web site You should definitely ship the finished kind to the contractor by January 31 As all income from 1099 contracting flows through to your personal tax return, the following four tables will demonstrate the exact cutoff points and tax rate schedules for 1099 contractors as they pertain to all of the said filing statuses Notice that the tax rates and brackets for filers who chose married filing jointly and qualifying1/7/21 How to make more money from 1099 deduction expenses as an independent contractor There are a few things that can be done to write off taxes and make more money 1 Home office An independent contractor or a self employed individual has the liberty to work from their choice of space, which can also be their home

What If I Am A 1099 Contractor And I Get Injured Snow Carpio Weekley Plc

1099 contractor

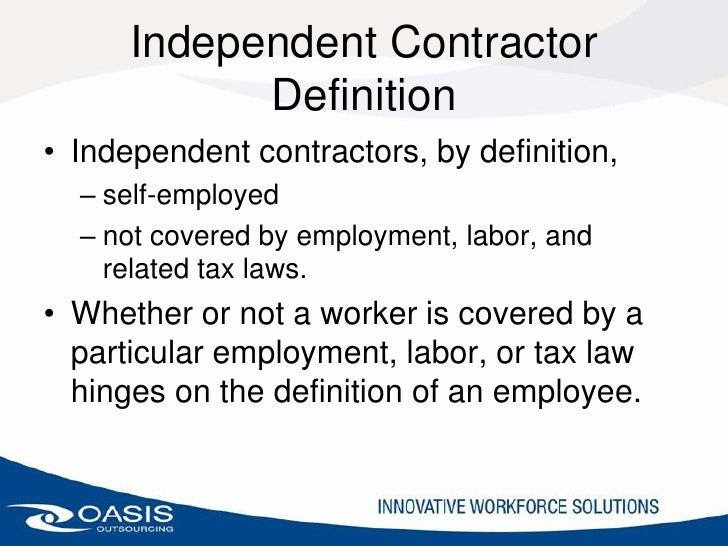

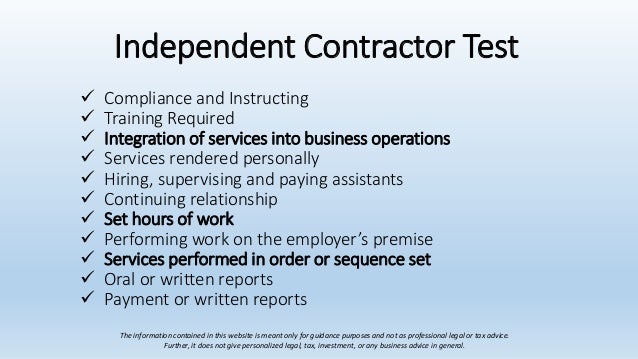

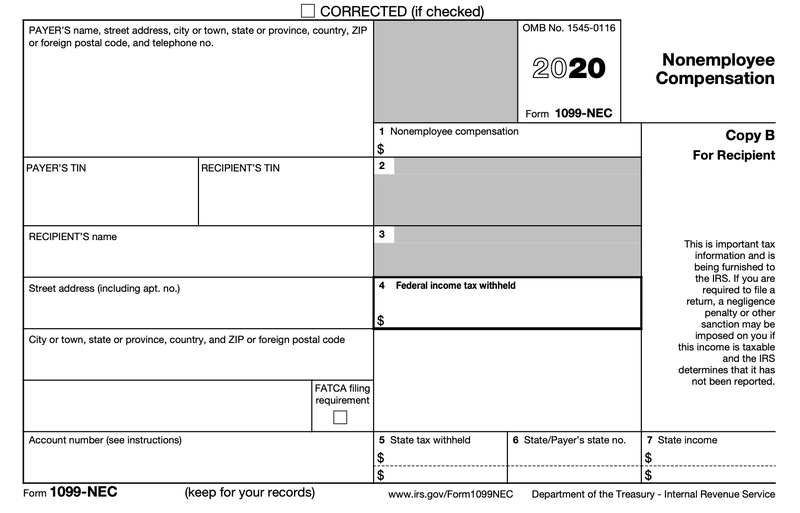

1099 contractor-The IRS defines an independent contractor as an individual whose payer has the right to control the direct result of the work, not what will be done and how it will be doneSTEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors, once you have bought the 1099 forms Fill in your Federal Tax ID number (SSN or EIN) and contractor's information (SSN or EIN) accurately Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title "Nonemployee compensation"

W 9 Vs 1099 Understanding The Difference

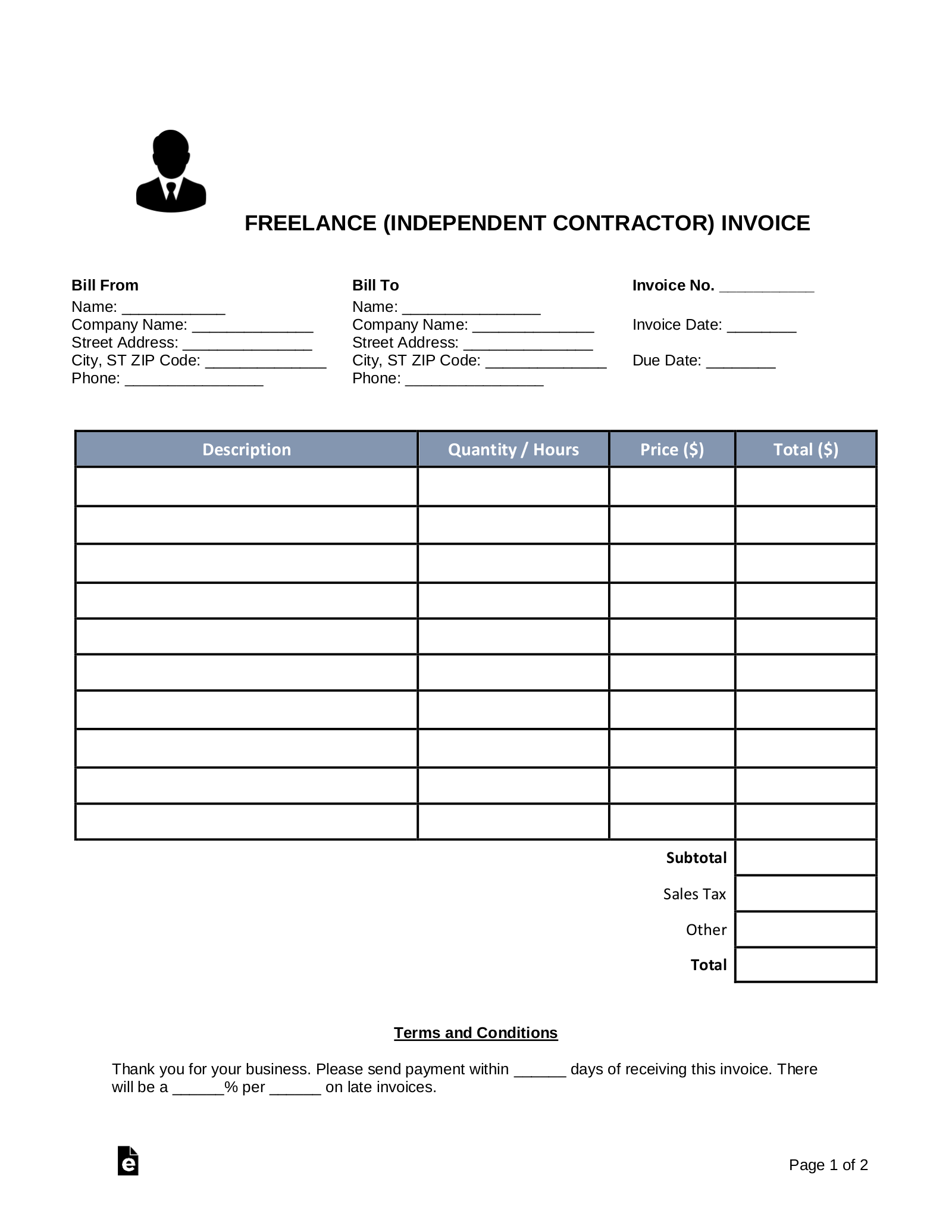

To file 1099MISC for USbased independent contractors, click this link and download the form For each contractor a company hires, a 1099MISC should report the sum of all payments made during the year A Form 1099 can be filed only on paper to the IRS, but there are services that will edeliver copies to contractors and mail them to the IRS2/4/21 The 1099 miscellaneous form is one of the legal proofs of income for 1099 independent contractors They can be easily generated through several online generators as long as the contractor has the right information to fill in the forms After generating them, the pay stubs can be printed and stored or sent to the necessary parties9/7/ A '1099 contractor', also referred to as 'selfemployed' or an 'independent contractor', is a person who works independently This means that they they work for themselves, and not for an employer Usually, 1099 contractors are paid on a freelance basis They often work through a limited company or franchise, which they own themselves

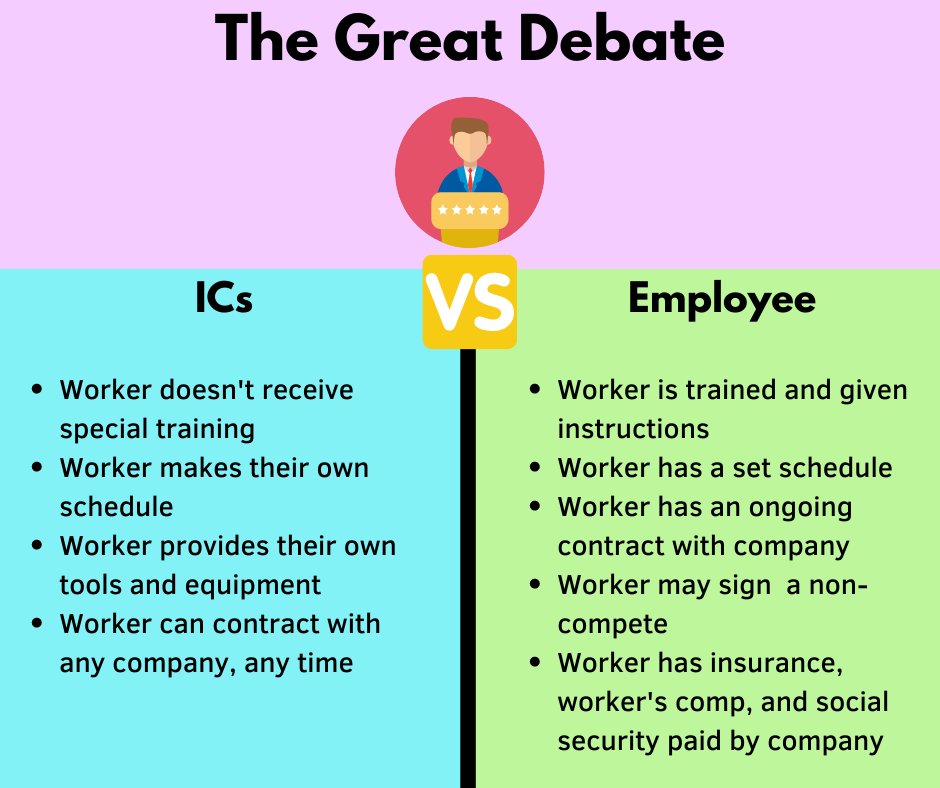

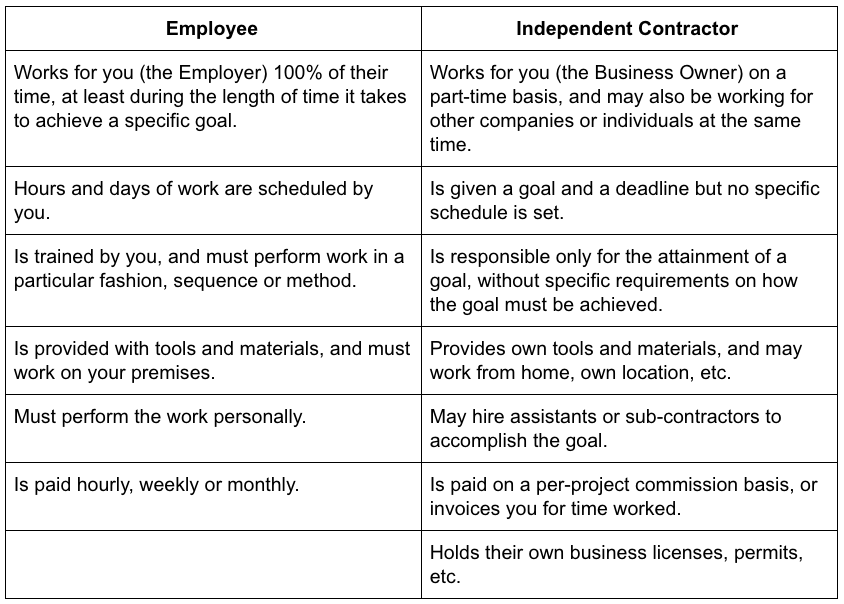

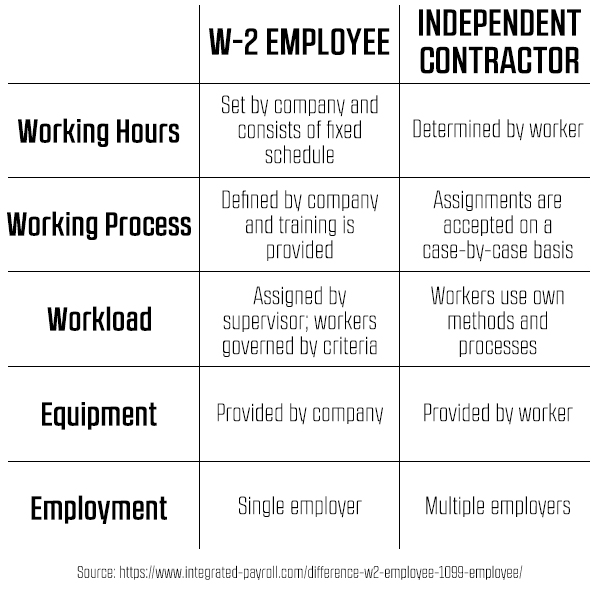

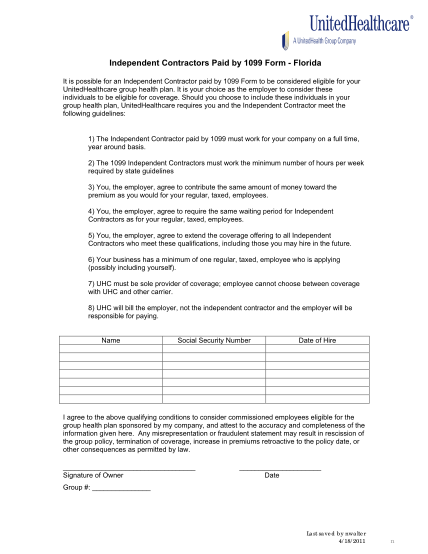

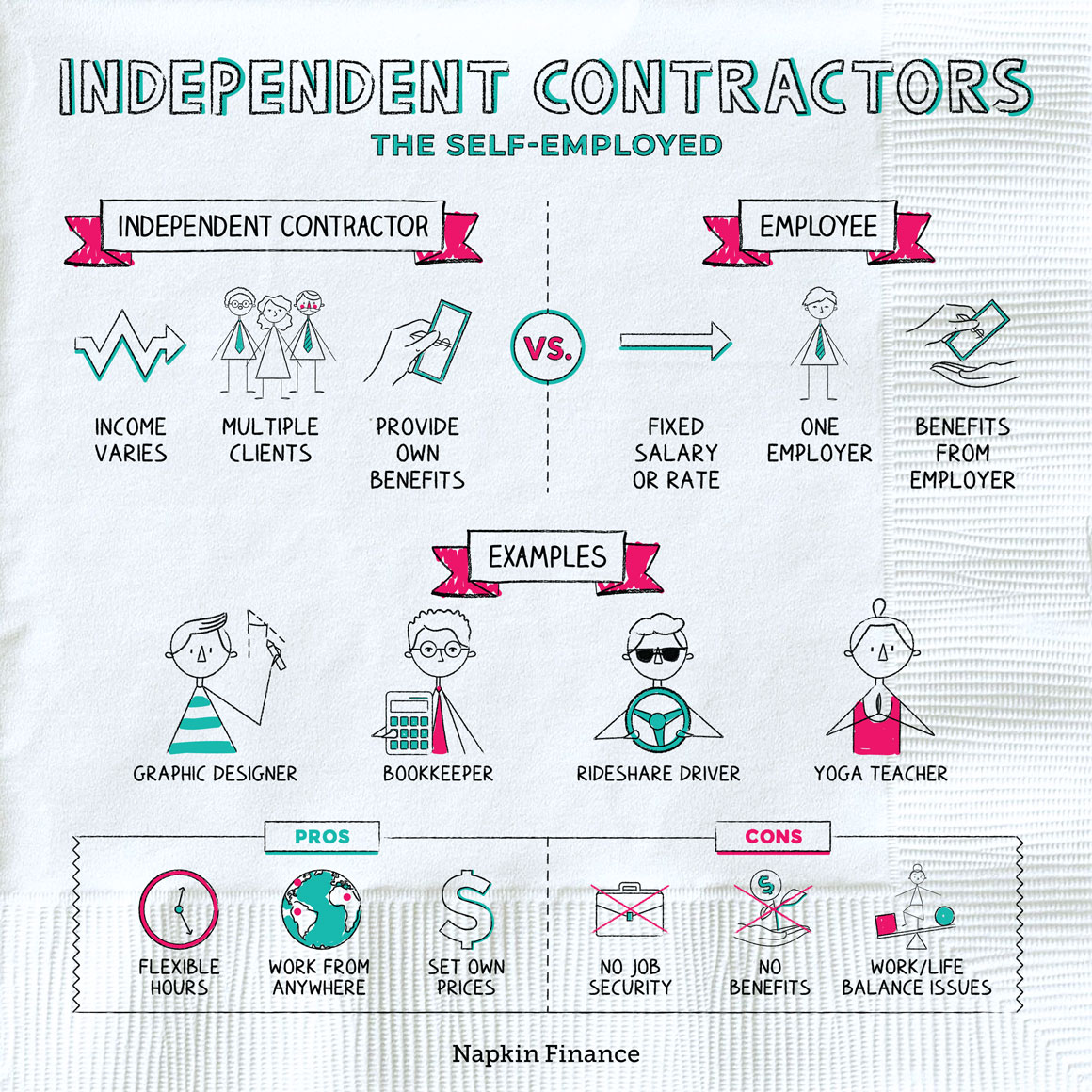

Instead he is an independent contractor, or consultant, who is considered to be selfemployed Like most selfemployed workers, they do not typically receive employee benefits, such as health insurance or retirement benefits, but they may have more flexible work schedules and locationsA 1099 contractor, also known as an independent contractor, is a classification assigned to certain US workers The "1099" reference identifies the tax form that businesses must file with the Internal Revenue Service (IRS), and it relieves the employer from the responsibility of withholding taxes from the individual's paychecks6/3/19 1099 and W2s are the different tax forms used to deduct payroll taxes on different types of employees 1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax return A W2 employee receives a regular wage and employee benefits

4/1/21 Posted on Employees report their income on W2 forms Independent contractors use 1099 forms In California, workers who report their income on a Form 1099 are independent contractors, while those who report it on a W2 form are employees Payroll taxes from W2 employees are automatically withheld, while independent contractsIn this post we are going to look at 1099 vs W2 Which is Better for Employee & Contractor in 21 Small business owners or newly setin startups who are looking forward to hiring employees have two choices to pick either a 1099 or w2 One is hiring employees on a payroll basis, and the second choice is to directly hire contract11/3/21 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxes

Independent Contractor

1099 Contractor Reporting Is It Really Necessary The Legal Paige

8/7/ What is a 1099 Contractor?5/1/18 These are referred to as "1099 contractors" since Form 1099 is the tax form that the IRS requires companies to file when they pay any contractor over $600 per year The 1099 filing typically only applies to USbased contractors, but there are exceptions to this rule, such as when a foreign contractor performs any services on US soilIndependent contractors (often called 1099 contractors in the US) are people who offer their professional services to clients They are usually selfemployed owners of small businesses that you hire for a fixed period of time or on a project basis Every country has its own regulations that define their independence

What If I Am A 1099 Contractor And I Get Injured Snow Carpio Weekley Plc

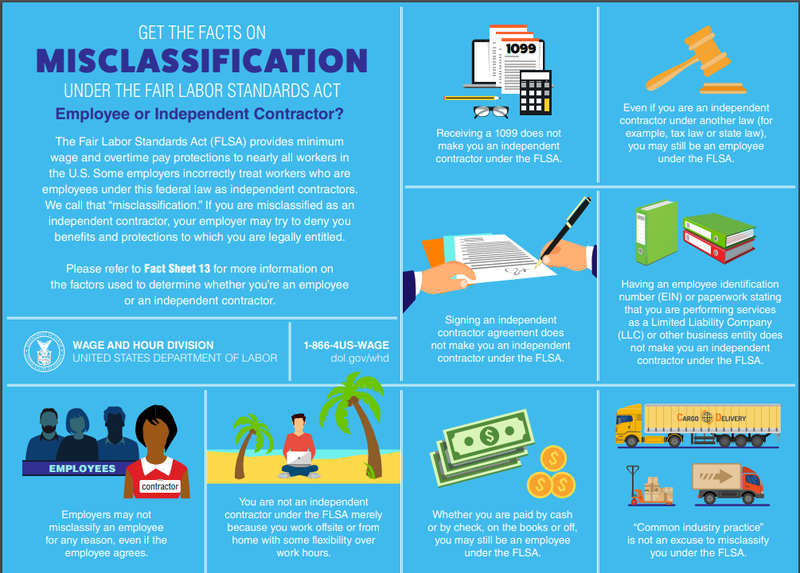

Misclassification 1099 Contractor Or Employee

IRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the workOne thing I forgot to mention, buy a mileage log book to track your daily miles, maintenance on your contacted vehicle for tax purposes!!6/9/ A 1099 worker, also known as an independent contractor, provides an entity's services as a nonemployee Independent contractors use a 1099 tax form rather than a W2 Unlike W2 employees whose payroll taxes are deducted from their paychecks by an employer, 1099 contractors file taxes independently

Employee Vs Independent Contractor How Tax Reform Impacts Classification Tax Pro Center Intuit

1099 Vs W2 Employee Guide For Construction Businesses

16/3/21 Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC)24/3/21 A 1099 contractor will often have a more complex skill set than other typical employees and are used more infrequently They might also work for multiple clients, and therefore have more freedom over their work schedule because they are not required to work under a traditional 9 to 5 schedule14/4/21 The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done The earnings of a person who is working as an independent contractor are subject to SelfEmployment Tax

/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Home › Independent Contractor Taxes › 1099 NEC vs 1099 MISC If you hire 1099 workers (ie any nonpayroll staff), you may already be familiar with the 1099 tax forms you need to complete and file every year, but here's a simple breakdown of 1099 NEC vs 1099 MISCAs the name implies, independent contractors (also known as 1099 workers, for the tax form they get instead of a W2) must be legally separated from the company for which they perform work This means no companypaid benefits, no tax withholding, no company payment of Social Security taxes — and no right to overtime21/1/21 If you're selfemployed or a freelancer, you likely get paid as an independent contractor rather than an employee The IRS defines an independent contractor as someone who performs work for someone else, while controlling the way in which the work is done In other words, someone pays you to perform a service or deliver a product, but they only have a say in the final

Employee Vs Independent Contractor Apollomd

W2 Or 1099 Employee Or Contractor What S The Difference Loganville Ga Patch

A 1099 contractor is a person who works independently rather than for an employer There are significant differences in the legalities of a contractor and employee While the work can be similar in nature, it is important to follow the law with regard to taxes, payments, and the like24/7/21 Job detailsJob type fulltime contractFull job descriptionPosition title quality assurance engineer (1099 contractor)Department marketingHours required 40 hours/weekLength of assignment up to one yearLocation remote but must be est time zoneSupervisor director, business intelligencePosition summaryThe quality assurance (qa) engineer contractor position1099 Taxes Checklist Who Is An Independent Contractor?

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

W 2 Employees Vs 1099 Contractors Due

"1099 Reports" shows the 1099 Summary Report just for this contractor This is a preview of the dollar amounts that will appear when you create the Form 1099 for this contractor To edit a contractor Payroll > 1099 Contractors > Contractor List Click the Contractor name You are now on the "Contractor Info" page Click EditContractors often cost more per hour than employees with equal experience and training However, because you only pay for hours worked, using a contractor is sometimes the most economical option However, the same IRS disclosure rules apply You still need to report your contractor's earnings each year on a 1099 form vs a W2 form for employees23/9/17 1 Have your contractor fill out a Form W9 This will provide you with all their identifying info Make sure to keep the Form W9 in your records for at least four years, and pay close attention to the business classification (ie sole proprietorship, S corp, etc), which will appear on #3 at the top of the form This will help you to determine whether or not you need to file a 1099

A 21 Guide To Taxes For Independent Contractors The Blueprint

W9 Vs 1099 A Simple Guide To Contractor Tax Forms Bench Accounting

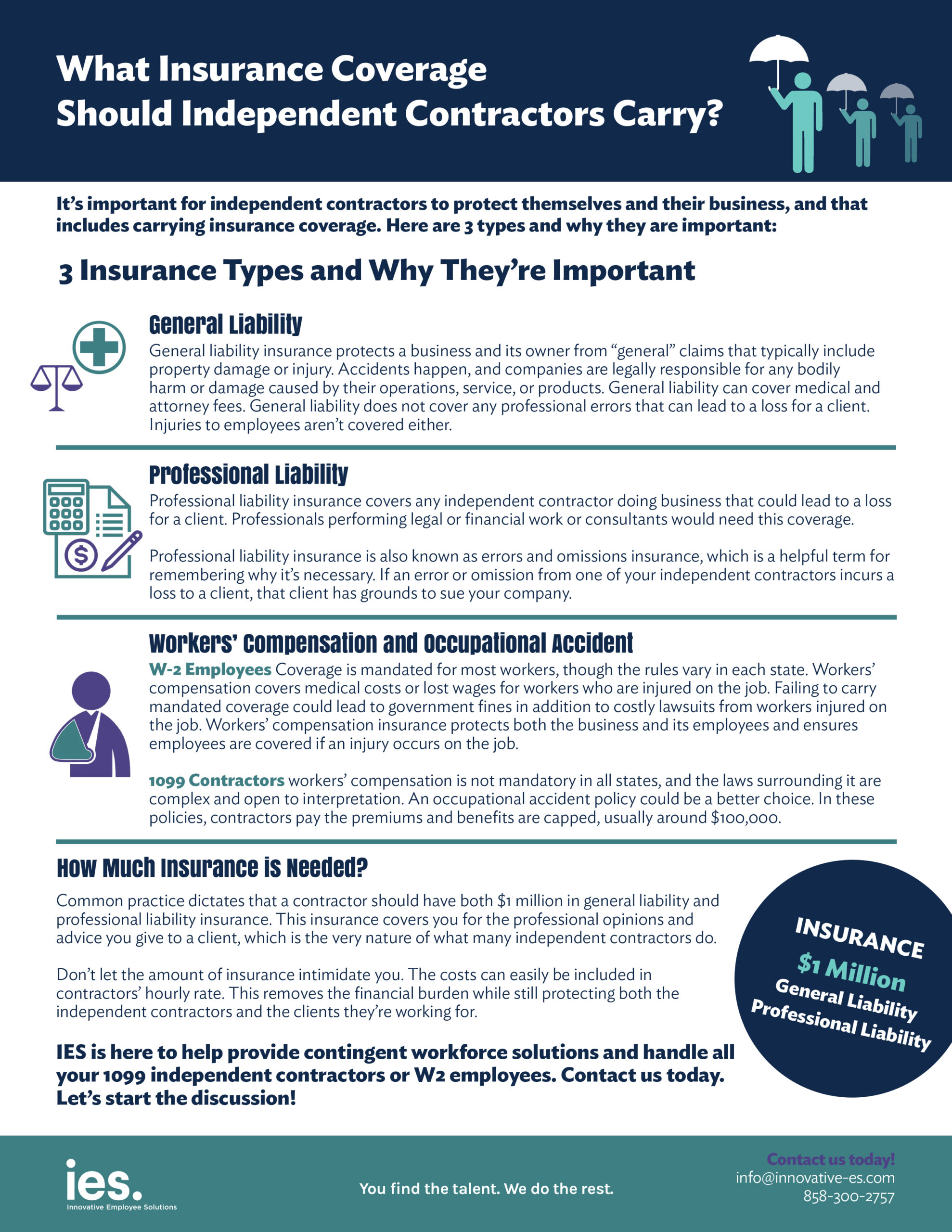

Liability Insurance For 1099 Contractor If you are looking for an online quote provider then our service can get you the best offers available15/9/ Independent Contractors, on the other hand, are usually provided with a completed copy of IRS Form 1099MISC (Opens in new window) by the business that paid them For this reason, many people refer to independent contractors as 1099 workers and traditional employees as W2 employees in the context of taxes561 1099 independent contractor Jobs 50 Transcynd Claim Partners Independent Contractor Assignments (1099) Outside Field AdjusterNationwide CAT/Daily Clearwater, FL $37K $68K (Glassdoor est) Easy Apply 19d Transcynd Claim Partners is a rapidly growing Independent Adjusting & Third Party Administration

W 9 Vs 1099 Understanding The Difference

Independent Contractors Vs Employees Hawaii Vantaggio Hr

Gig Wage makes 1099 independent contractor payroll an easy, fast and delightful experienceDo 1099 contractors pay more taxes?26/7/21 California EDD is looking for 1099 contractors whom they feel should now be classified as W2 workers Since AB5 and the Gig Work law went into effect, businesses who work with outside contractors are particularly vulnerable Use our tool to make the right decision BEFORE California EDD comes knocking Not every 1099 needs to be reclassified

Employee Vs Independent Contractor Which Is Better For Your Business

Independent Contractors Vs Employees Hawaii Vantaggio Hr

23/2/ 1099 vs W2 – Wondering which is better?For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter CONTRACTOR in his/her professional capacity to provide sales &/or marketingrelated servicesAlthough it might be compelling to be hired as an independent contractor, given the bigger sum you get paid, independent contractor taxes are higher 1099 contractors need to pay income taxes, selfemployment taxes, as well as cover their own social contributions (healthcare, insurance and other)

Hiring Independent Contractors Vs Full Time Employees Pilot Blog

How To Pay Tax As An Independent Contractor Or Freelancer

A 1099 contractor is not an employee of the business or businesses with which he works;14/6/21 But you want to make sure you are only claiming expenses directly related to your 1099 contracting work So, if you only have one phone, you'll generally claim the estimated percentage of time you use the phone for work But if you have a second phone line that you use exclusively for business, you can deduct 100% of that phone bill Being a selfemployed 1099 contractor or freelancer has its perks You can work flexible hours and enjoy deductions unavailable to those who get a W2 instead of 1099s But with its advantages come responsibilities Among these are paying quarterly estimated taxes

Misclassification 1099 Contractor Or Employee

What Tax Forms Do I Need For An Independent Contractor Legal Io

You need to report the form 1099 – NEC if you received any service from a nonemployed contractor/vendor, and the stated value of that service was $600 or above during the year You should also file the form 1099 – NEC if you have received any service from a nonemployed contractor or vendor, with a value above $600, whom you also reported last year on the 1099 –6/7/ How to Register With the IRS as an Independent Contractor If you are selfemployed, you can start with Form 1040ES (Estimated Tax for Individuals), and then file the other necessary forms with your 1040 Form during the tax season If you need help with a 1099 contractor needing a business license, you can post your job on18/8/21 1099 contractors are often freelancers and do related jobs They tend to have more than one project at a time These workers are held accountable for their taxes However, when hiring a 1099 contractor, you have to file an IRS Form, too Employers tend to hire 1099 contractors when they need help from an expert to work on a specific project

Who Should You Hire Independent Contractor Vs Employee Top Echelon

1

Keep all gas receip16/6/ Form 1099NEC Beginning with tax year , Form 1099NEC replaces the previously used Form 1099MISC for independent contractors This form is used by companies to report payments made in the course of a trade or business to others for services It must be filed by any company that pays an independent contractor $600 or more during the year1/4/21 A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the company

Can A Person Be Both An Employee And An Independent Contractor Quora

How To File 1099 Misc For Independent Contractor Checkmark Blog

Once you know which contractors you paid over $600 to, you will need to fill out Form 1099NEC Starting at the upper left box, record your organization's name as the PAYER The PAYER TIN is the organization's tax identification number The RECIPIENT'S TIN is the contractor's SSN or business TIN

Do You Need A W 2 Employee Or A 1099 Contractor How To Start Grow And Scale A Private Practice Practice Of The Practice

Independent Contractors Vs Employees California Vantaggio Hr

How To Become A 1099 Independent Contractor As A Physician Assistant Youtube

1099 Reasons To Hire Independent Contractors Ascend Business Advisory

Ab 5 And The New Abcs Of Worker Classification Infographic

Jan 31 Filing Deadline Remains For Employer Wage Statements Independent Contractor Forms Cozby Company

1099 Misc Instructions And How To File Square

1099 Form Independent Contractor Free

1099 Form Independent Contractor Agreement

1099 Independent Contractors Tax Strategies

1099 Vs W2 How 4 Different Agencies View Independent Contractor Relationships Infographic Employers Resource

Handling Your Finances As A 1099 Contractor

Why Independent Contractor Vs Employee Status Matters Mga

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

What Is An Independent Contractor 1099 Contractor

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

Create An Independent Contractor Agreement Download Print Pdf Word

Biden Withdraws Trump S Independent Contractor Rule

Employee Vs Independent Contractor

What Insurance Coverage Should Independent Contractors Carry

What Is An Independent Contractor Napkin Finance Has Your Answer

Independent Contractor 101 Bastian Accounting For Photographers

Hws Policies And Guidelines

A 21 Guide To Taxes For Independent Contractors The Blueprint

Can The Same Person Be An Employee And An Independent Contractor

Advantages Of 1099 Contractors Hr Daily Advisor

Independent Contractor 1099 Compliance Services

Employee Versus Independent Contractor The Cpa Journal

Free Freelance Independent Contractor Invoice Template Word Pdf Eforms

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

Should You Choose 1099 Or W 2 Independent Contractor Tax Advisors

Employee Misclassification What Happens When You Mistake An Employee For An Independent Contractor

How To Pay Contractors And Freelancers Clockify Blog

Dj Independent Contractor Or Employee Dj Insurance In Minutes

1099 Vs W2 Employee Guide For Construction Businesses

What Is Independent Contractor Insurance Coterie Insurance

1099 Workers Vs W 2 Employees In California A Legal Guide 21

Independent Contractor 101 Bastian Accounting For Photographers

Free Independent Contractor Agreement Free To Print Save Download

The Difference Between An Employee Independent Contractors

Employee Or Independent Contractor Factors And Decisions

A 21 Guide To Taxes For Independent Contractors The Blueprint

Employee Vs Independent Contractor What S The Difference

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

Hiring Guide For 1099 Independent Contractors Legalities Forms Taxes Exaktime

The Pros And Cons Of Hiring Independent Contractors Zitrod Guest Post

Independent Contractor Homeschoolcpa Com

Ask General Counsel What S The Difference Between A 1099 Contractor And A W 2 Employee Business Insidenova Com

Understanding The Differences Between Hiring An Employee Or An Independent Contractor Dcc Accounting

Independent Contractor Vs Employee Explained California Law 21

1

15 Printable 1099 Form Independent Contractor Templates Fillable Samples In Pdf Word To Download Pdffiller

1

Free Independent Contractor Agreement Pdf Word

What Is A 1099 Contractor With Pictures

Top Small Business Question 9 Did You Hire An Employee Or An Independent Contractor Pk Boston Law

Should I Agree To Be Paid As An Independent Contractor

New 1099 Nec Form For Independent Contractors The Dancing Accountant

My Employer Says I M An Independent Contractor Does L I Cover Me

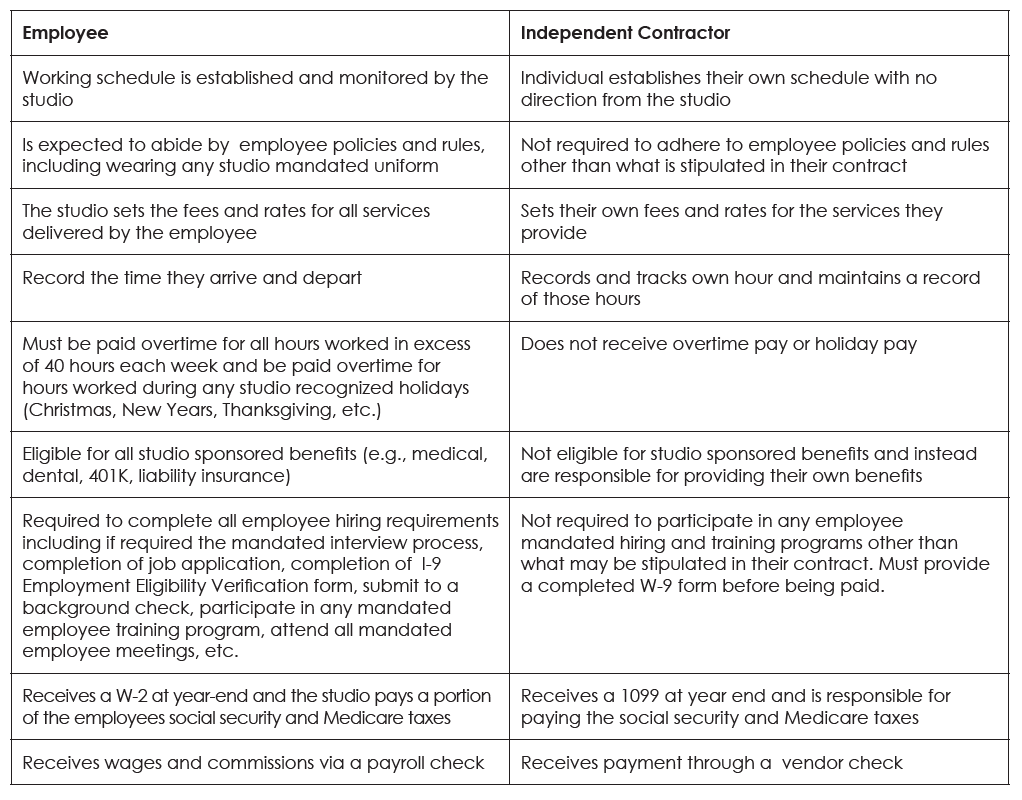

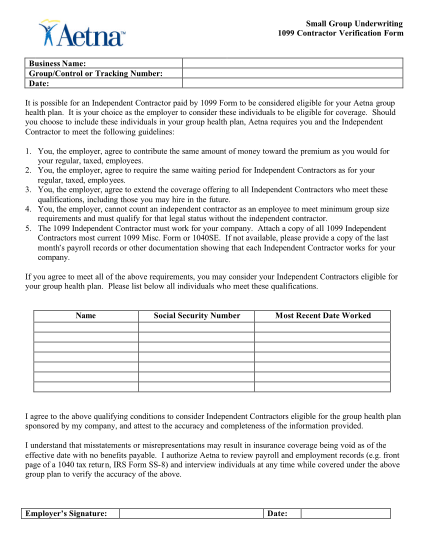

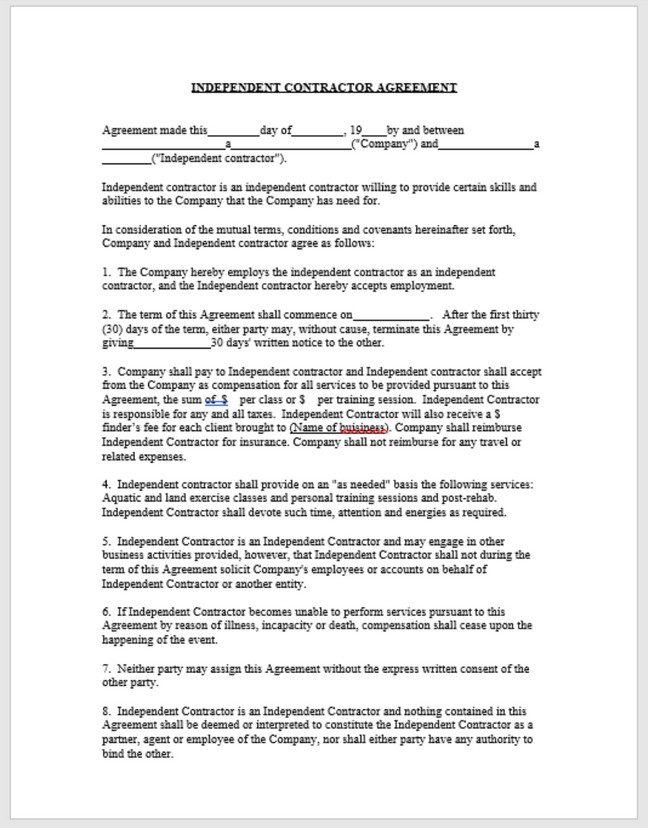

Employee Or Independent Contractor Which One Is Best For My Business The Association Of Fitness Studios

What Is Form 1099 Nec

Independent Contractor 101 Bastian Accounting For Photographers

Independent Contractor 101 Bastian Accounting For Photographers

Who Are Independent Contractors And How Can I Get 1099s For Free

Infographic Contractor Vs Employee What Is The Difference Milikowsky Tax Law

Independent Contractor Taxes Priority Hr

Form 1099 Nec For Nonemployee Compensation H R Block

Independent Contractors Vs Employees California Vantaggio Hr

A Small Business Guide To Independent Contractors The Blueprint

Employee Vs Independent Contractor Why It Matters The National Psychologist

Contractors Please Claim Your Independence Tax Form 1099

The Consequences Of Misclassifying Your 1099 Contractors Tlnt

Independent Contractor And Employee Differences Businessnewsdaily Com

12 1099 Form Independent Contractor Free To Edit Download Print Cocodoc

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Business Lawyer Tampa

1

Employee Vs Independent Contractor Apollomd

0 件のコメント:

コメントを投稿